Apollo Realty Income Solutions (“ARIS”) is a perpetually offered, non-traded corporation that elected to be taxed as a real estate investment trust ("REIT") focused on investing in substantially stabilized, well-leased, income-oriented commercial real estate assets throughout the United States. ARIS provides individual investors access to Apollo Global Management’s premier real estate investment and lending platform and high-conviction, thematic approach to investing.

Apollo Realty Income Solutions

Overview

About

Apollo Realty Income Solutions (ARIS) is Apollo’s flagship direct real estate income product in the United States, providing individual investors access to Apollo’s “Best Ideas” for income-generating commercial real estate investments.

Strategy

ARIS’ investment strategy is focused on well-leased, income-oriented commercial real estate and mortgages securing commercial properties. ARIS utilizes a strategic approach to portfolio construction, targeting specific themes and property types and harnessing the resources, market knowledge and expertise of the broader Apollo platform. ARIS proactively asset manages the properties in an effort to create value, with a goal of capital appreciation.

Asset Management and Selection Process

With a Focus on Creating a Dynamic Portfolio of Income-Oriented Real Estate Assets

Well-Leased Properties

- Stabilized, well-located properties throughout the U.S. in which Apollo has high conviction in the underlying asset class and geography

- Examples include industrial, multifamily, essential retail, life sciences, manufactured housing and hospitality

- Opportunity for capital appreciation through pro-active management

Real Estate Related Debt

- Select performing mortgage investments originated by Apollo’s leading global real estate credit platform

Potential Benefits and Features

| Name | Apollo Realty Income Solutions, Inc. (“ARIS”) |

| Structure | Non-exchange traded, perpetual life real estate investment trust ("REIT") |

| Maximum Offering(9) | $5 billion |

| Offering Price(10) | Generally equal to our prior month’s NAV per share for such class as of the last calendar day of such month, plus applicable upfront selling commissions and dealer manager fees |

| Strategy | ARIS invests primarily in substantially stabilized, well-leased, income-producing commercial real estate assets in the United States that have attractive long-term fundamentals, with a potential for capital appreciation. To a lesser extent, ARIS may invest in real estate debt or real estate-related debt securities on a selective basis or to provide a source of liquidity |

| Minimum Initial Investment (11) | $2,500 |

| Upfront Selling Commission and Dealer Manager Fee | Class S: Up to 3.0% of the transaction price for upfront selling commission and up to 0.5% of the transaction price for Dealer Manager Fees(12) Class D: Up to 1.5% of the transaction price Class I: None |

| Stockholder Servicing Fees | Class S: 0.85% per annum, calculated on NAV, paid monthly Class D: 0.25% per annum, calculated on NAV, paid monthly Class I: None |

| Management Fee | 1.25% of NAV per annum, payable monthly |

| Performance Participation Interest(13) | 12.5% of the annual total return, subject to a 5% annual hurdle rate with a catch-up |

| Subscriptions/NAV Frequency

| Monthly purchases as of the first business day of each month; subscription requests must be received at least five business days prior to the first business day of the month. Transaction price will be available on our website and in prospectus supplements. If the transaction price is not made available on or before the eighth business day before the first business day of the month, or a previously disclosed transaction price for that month is changed, then we will provide notice of such transaction to subscribing investors. |

| Distributions(14) | Monthly (subject to Board approval) |

| Share Repurchase Plan(15) | Up to 2% of ARIS’ aggregate NAV per month and up to 5% of its aggregate NAV per quarter |

| Tax Reporting | Annual Form 1099-DIV |

| Investor Suitability | Either (1) a net worth of at least $250,000 or (2) a gross annual income of at least $70,000 and a net worth of at least $70,000; Certain states have established suitability standards in addition to or greater than the minimum income and net worth standards described above. See ARIS' prospectus for more information. |

Featured Investments

Senior Mortgage Loan⁽²¹⁾

Pictured above: Property image of Project Flash 2.0 in Abilene, TX

Loan Amount: $100 million pari passu interest in a $2 billion allocation of three uncrossed first mortgages totaling ~$7 billion

Location: Abilene, TX

Collateral: Preleased purpose-built data center campus totaling ~3 million sq. ft.

Closing Date: May 2025

Interest Rate: SOFR + 225 basis points

Multifamily⁽²²⁾

Pictured above: Property image from Parc Westborough in Westborough, MA

Purchase Price: $96.2 million

Location: Westborough, MA

Deal Profile: 249-unit, garden-style multifamily asset

Closing Date: May 2025

Property Amenities: Saltwater pool, dog spa, fitness center

Senior Mortgage Loan⁽²¹⁾

Pictured above: Property image of a self-storage asset in Richmond, CA

Loan Amount: $97 million pari passu interest in a $646.7 million floating-rate first mortgage loan

Location: Various (USA)

Collateral: 25-asset self-storage portfolio comprising ~3 million sq. ft. and ~27,000 units located across eight states

Closing Date: April 2025

Interest Rate: SOFR + 285 basis points

Senior Mortgage Loan⁽²¹⁾

Pictured above: Property rendering of Luxury Seattle Multifamily development in Seattle, WA

Loan Amount: $50 million pari passu interest in a $275 million senior mortgage loan

Location: Seattle, WA

Collateral: 796-unit to-be-constructed luxury multifamily property

Closing Date: March 2025

Interest Rate: SOFR + 375 basis points

Senior Mortgage Loan⁽²¹⁾

Pictured above: Property image of West Jordan Data Center Campus in West Jordan, UT

Loan Amount: $50 million pari passu interest in a $1.5 billion senior mortgage loan

Location: West Jordan, UT

Collateral: ~990,000 sq. ft. to-be-constructed data center campus

Closing Date: March 2025

Interest Rate: SOFR + 350 basis points

Industrial⁽²²⁾

Pictured above: Property image from McLane Cold Storage in Columbus, OH

Purchase Price: $76 million

Location: Columbus, OH

Deal Profile: ~179,000 sq. ft. cold storage facility

Closing Date: March 2025

Tenant: McLane Company, a subsidiary of Berkshire Hathaway

Senior A-Note⁽²¹⁾

Pictured above: Downtown Manhattan Hotel in New York, NY

Loan Amount: $25 million pari passu interest in a $140 million senior A-note

Location: New York, NY

Collateral: 367-key, 27-story luxury hotel

Closing Date: October 2024

Interest Rate: SOFR + 360 basis points

Senior Mortgage Loan⁽²¹⁾

Pictured above: Property rendering of Florida Condo Construction in Hillsboro Beach, FL

Loan Amount: $50 million pari passu interest in a $307 million floating-rate senior mortgage loan

Location: Hillsboro Beach, FL

Collateral: 92-unit to-be-constructed ultra luxury condo development

Closing Date: November 2024

Interest Rate:SOFR + 425 basis points

Senior Mortgage Loan⁽²¹⁾

Pictured above: Project Flash in Abilene, TX

Loan Amount: $125 million pari passu interest in a $2.25 billion floating-rate first mortgage loan

Location: Abilene, TX

Collateral: ~998,000 square foot to-be-constructed purpose-built data center facility

Closing Date: December 2024

Interest Rate: SOFR + 250 basis points

Senior Mortgage Loan⁽²¹⁾

Pictured above: Property rendering of Herndon Data Center in Herndon, VA

Loan Amount: $75 million pari passu interest in a $445 million floating-rate first mortgage loan

Location: Herndon, VA

Collateral: To-be-constructed ~359,000 sq. ft. data center facility

Closing Date: August 2024

Interest Rate: SOFR + 440 basis points

Senior Mortgage Loan⁽²¹⁾

Pictured above: Property rendering of Life Science Labs in Bedford, MA

Loan Amount: $25 million pari passu interest in a $150 million floating-rate first mortgage loan

Location: Bedford, MA

Collateral: Newly-converted ~288,000 sq. ft. fully-leased life science building

Closing Date: August 2024

Interest Rate: SOFR + 325 basis points

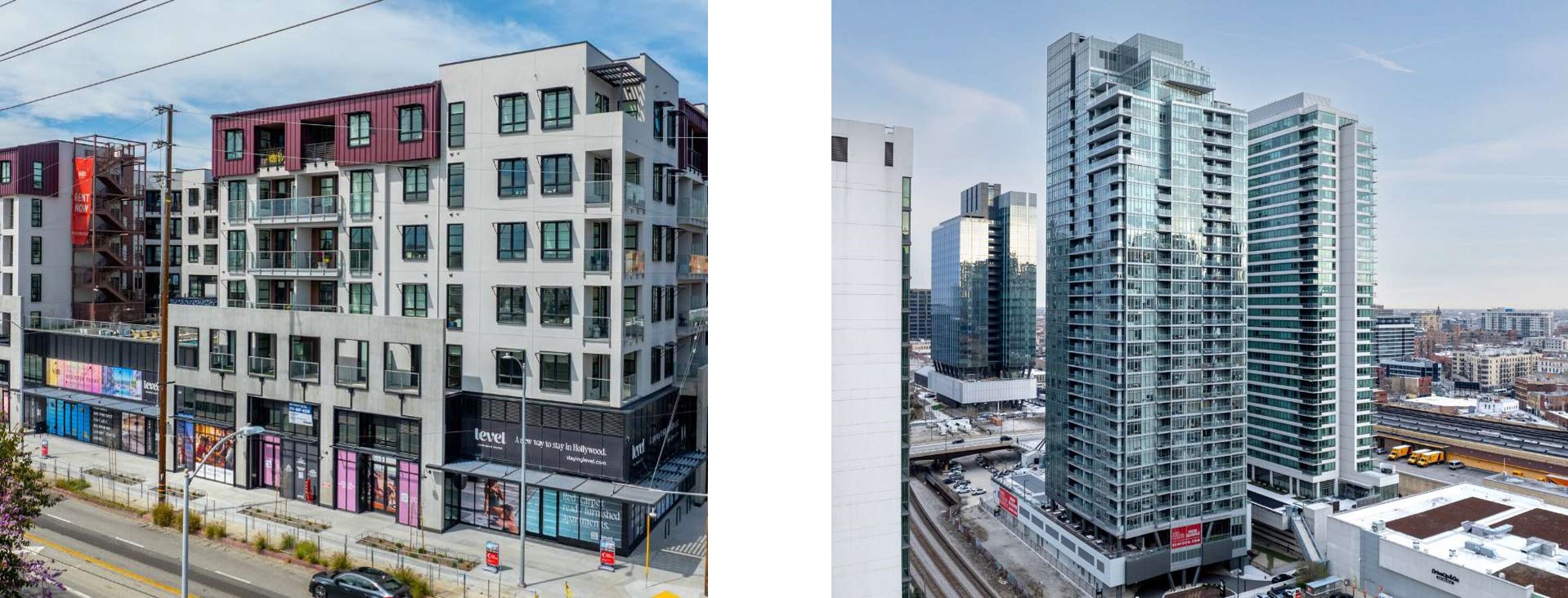

Mezzanine Loan⁽²¹⁾

Pictured above: Images of the Multifamily Portfolio properties in Los Angeles, CA and Chicago, IL

Loan Amount: $63 million pari passu interest in a $125 million fixed-rate first mezzanine loan

Location: Los Angeles, CA & Chicago, IL

Collateral: Equity interests in the owner of a portfolio of 8 newly-delivered, luxury multifamily properties. The pictured properties are a part of the portfolio

Closing Date: July 2024

Interest Rate: 11.0%

Senior Mortgage Loan⁽²¹⁾

Pictured above: Property rendering of the Multifamily Construction in Jersey City, NJ

Loan Amount: $65 million pari passu interest in a $210 million floating-rate first mortgage loan

Location: Jersey City, NJ

Collateral: To-be-constructed 757-unit luxury multifamily property

Closing Date: July 2024

Interest Rate: SOFR + 425 basis points

Senior Mortgage Loan⁽²¹⁾

Pictured above: Property rendering of the Ashburn Data Center in Ashburn, VA

Purchase Price: $65 million pari passu interest in a $190 million floating-rate first mortgage loan

Location: Ashburn, VA

Collateral: ~528,000 sq. ft. to-be-constructed hyperscale data center

Closing Date: June 2024

Interest Rate: SOFR + 350 basis points

Loan Term: 3 years, with two 1-year extension options

Senior Mortgage Loan⁽²¹⁾

Pictured above: Property rendering of Phoenix Multifamily in Phoenix, AZ

Purchase Price: $35 million pari passu interest in a $120 million floating-rate first mortgage loan

Location: Phoenix, AZ

Collateral: In-construction luxury, 400-unit multifamily property located in the Paradise Valley submarket of Phoenix, AZ

Closing Date: June 2024

Interest Rate: SOFR + 300 basis points

Loan Term: 2 years, with three 1-year extension options

Multifamily⁽²²⁾

Pictured above: The Beckett in Charleston, SC

Purchase Price: $49 million

Location: Charleston, SC

Deal Profile: Newly constructed, 186-unit, garden-style multifamily property

Closing Date: May 2024

Property Amenities: Saltwater pool, modern clubhouse, private workspaces, fitness center, yoga center, outdoor grilling area, bocce court, package room

Industrial⁽²²⁾

Pictured above: PepsiCo / Quaker Distribution Center in Byhalia, MS

Purchase Price: $58 million

Location: Byhalia, MS (Memphis MSA)

Deal Profile: ~708,000 sq. ft. distribution center

Closing Date: May 2024

Tenant: Affiliate of PepsiCo

Senior Mortgage Loan⁽²¹⁾

Pictured above: Property rendering of Data Center Campus – Phase II in Gainesville, VA

Loan Amount: $85 million pari passu interest in a $667.0 million floating-rate first mortgage loan

Location: Gainesville, VA

Collateral: To-be-built hyperscale turnkey data center

Closing date: March 2024

Interest Rate: SOFR + 390bps

Loan Term: Three-year initial term with two, 1-year extension options

Senior Mortgage Loan⁽²¹⁾

Pictured above: Dual-Branded Hotel in Los Angeles, CA

Loan Amount: $50 million pari passu interest in a $250.0 million floating-rate first mortgage loan

Location: Los Angeles, CA

Collateral: A newly developed 727-key dual-branded hotel and state-of-the-art digital signage totaling ~15,000 of square footage and ~22 million pixels

Closing date: February 2024

Interest Rate: SOFR + 375bps

Loan Term: Three-year initial term with two, 1-year extension options

Senior Mortgage Loan⁽²¹⁾

Pictured above: Multifamily property in San Francisco, CA

Loan Amount: $60 million pari passu interest in a $410.0 million floating-rate senior mortgage loan

Location: San Francisco, CA

Collateral: 75 multifamily properties located throughout San Francisco

Closing Date: December 2023

Interest Rate: SOFR + 300bps

Loan Term: Three-year initial term with two, 1-year extension options

Senior Mortgage Loan⁽²¹⁾

Pictured above: Downtown New York Multifamily in New York, NY

Loan Amount: $50 million pari passu interest in a $150.0 million floating-rate senior mortgage loan

Location: Downtown Manhattan, NY

Collateral: 35-story, 416-unit, 100% market rate multifamily property with 5,858 SF of ground floor retail

Closing Date: December 2023

Interest Rate: SOFR + 300bps

Loan Term: Three-year initial term with two, 1-year extension options

Senior Mortgage Loan⁽²¹⁾

Pictured above: Boston Multifamily Property in Boston, MA

Loan Amount: $26 million pari passu interest in a $126.0 million floating-rate first mortgage loan

Location: Boston, MA

Collateral: Recently developed multifamily property totaling 451 residential units (383 market-rate / 68 affordable) and 15,785 SF of commercial space

Closing Date: November 2023

Interest Rate: SOFR + 360bps

Loan Term: 12-month initial term with one, 6-month extension option

Senior Mortgage Loan⁽²¹⁾

Pictured above: Property rendering of Michigan Multifamily Development in Ann Arbor, MI

Loan Amount: $25 million pari passu interest in a $92.4 million floating-rate first mortgage loan

Location: Ann Arbor, MI

Collateral: To-be-constructed multifamily rental community comprising 456 residential units spanning 1-3 bedroom stacked apartments and 3-bedroom “townhome” and “ranch” style units

Closing Date: November 2023

Interest Rate: SOFR + 425bps

Loan Term: Five-year initial term with two, 1-year extension options

Industrial⁽²²⁾

Pictured above: Hallmark Distribution Center II in Liberty, MO

Purchase Price: $65 million

Location: Liberty, MO

Deal Profile: 847K SF industrial distribution facility

Tenant: Hallmark Marketing Company, guaranteed by Hallmark Cards, Inc.

Acquisition Date: October 2023

Lease Economics: ~10 years of remaining lease term and 2.25% annual rent escalations

Senior Mortgage Loan⁽²¹⁾

Pictured above: Property rendering of California Production Campus in Burbank, CA

Loan Amount: $100 million pari passu interest in a $480 million floating-rate senior mortgage loan

Location: Burbank, CA

Collateral: To-be-constructed studio production campus, aggregating ~934,000 square feet, fully leased to Warner Bros. for a 15-year term, post-completion

Closing Date: August 2023

Interest Rate: SOFR + 400bps

Loan Term: 42-month initial term, with two extension options of 12 months and 6 months, respectively

Mezzanine Loan⁽²²⁾

Pictured above: Amazon distribution center in Albuquerque, NM

Loan Amount: $50 million pari passu interest in a $150 million fixed rate mezzanine loan

Location: Various (USA)

Collateral: Portfolio of 12 single-tenant, Class-A industrial warehouse/distribution properties each leased to Amazon on long-term leases

Closing Date: August 2023

Loan Term: 3 years

Essential Retail⁽²²⁾

Pictured above: 16000 Pines Market in Pembroke Pines, FL

Purchase Price: $56 million

Location: Pembroke Pines, FL

Deal Profile: 100% leased grocery-anchored shopping center

Anchor Tenants: Publix, Burlington, and Crunch Fitness

Acquisition Date: August 2023

Lease Economics: ~12 years of property weighted average lease term

Upsize of Senior Mortgage Loan⁽²¹⁾

Pictured above: Hotel property in Boston, MA

Loan Amount: $25 million pari passu interest in a $50 million upsizing of an existing floating rate senior loan, $140 million of which is held by an affiliate of Apollo

Location: Various (USA)

Collateral: Portfolio of seven hotels located across six markets, totaling 1,908 keys

Closing Date: June 2023

Interest Rate: SOFR + 415bps

Loan Term: 2.1 years through initial maturity, with one, 1-year extension option

Senior Mortgage Loan⁽²¹⁾

Pictured above: Three-pack hotel property in Breckenridge, CO

Loan Amount: $25 million pari passu interest in a $133.5 million floating-rate first mortgage loan

Location: Breckenridge, CO & Clearwater, FL

Collateral: Three-asset, 412-key hotel portfolio

Closing Date: June 2023

Interest Rate: SOFR + 375bps

Loan Term: 3 years (plus two, 1-year extension options)

Senior Mortgage Loan⁽²¹⁾

Pictured above: Property rendering of Gainesville Data Center in Gainesville, VA

Loan Amount: $50 million pari passu interest in a $530 million first mortgage loan

Location: Gainesville, VA

Collateral: ~482,000 sq. ft. to-be-constructed hyperscale data center 100% leased to a AAA-rated technology company for a 15-year lease term

Closing Date: May 2023

Interest Rate: SOFR + 410bps

Loan Term: 3 years (plus two, 1-year extension options)

No results containing your search criteria were found. Please try adjusting the filters.

Suggestions:

- Make sure all words are spelled correctly.

- Try different keywords.

- Try more general keywords.

These investment examples have been provided for discussion purposes only and were selected using an objective, non-performance based criteria, to illustrate recent investment activity. It should not be assumed that these investments were or will be profitable. Past performance is neither indicative, nor a guarantee of future returns. There is no guarantee that similar opportunities will become available in the future or, if available, that such opportunities will be profitable.

Management Team

Management Team

Resources

Interested in Learning More?

Key Contacts

Global Wealth

To get in touch with one of our team members, please provide us with the following information.

If you already have a relationship with Apollo, please reach out to your Relationship Manager. If you are an Investor, please connect with your Financial Advisor.